Russian automotive industry: Market review 2021 and perspectives in 2022

April 22nd, 2022

Market Review in 2021

Russian car Market in 2021 According to the Association of European Businesses (AEB), 1.667 mln new passenger cars and light commercial vehicles were sold in the Russian market in 2021. Thus, the market grew by 4.3% compared to 2020. In the first half of the year, the growth was 37% (871 ths.) due to low starting indicators, and already in the second half of the year there was a drop: in October sales decreased by 18%, and in November and December — by 20%. 796 ths. cars were sold from July to December.

At the same time, experts say that the Russian market has great potential. And sales growth in 2021 could be even higher: due to the shortage of cars, it was not possible to satisfy all consumers' demand. The shortage is attributed to a shortage of electronic components, logistics disruption and rising prices for raw materials, in particular steel.

Despite the fact that in 2021 the deferred demand has decreased, the interest of buyers in the most popular models remains high.

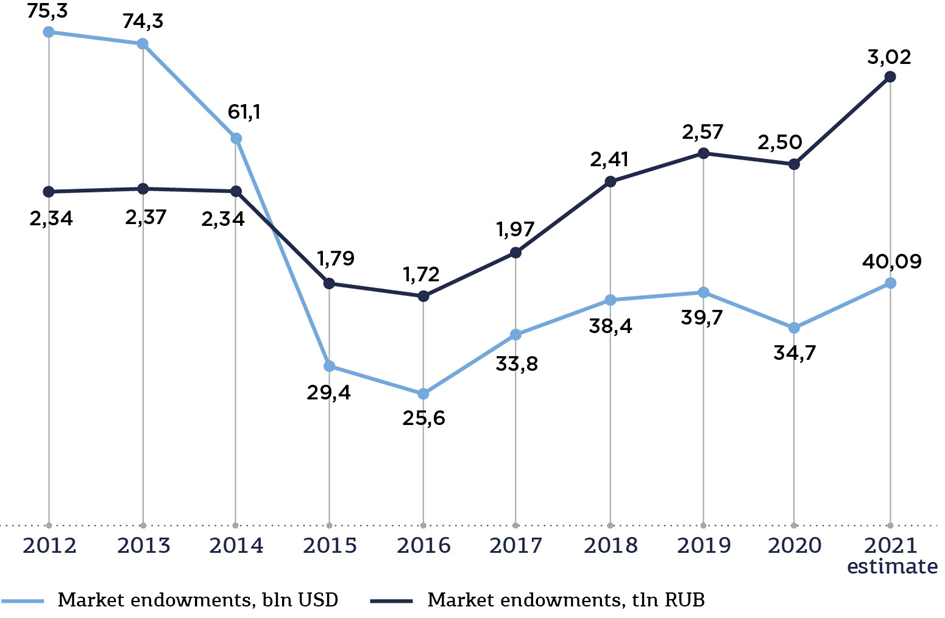

Fig. 4. The capacity of the Russian car market in monetary terms 2021

Source: Autostat

Compared with the indicators of 2020, the market capacity in rubles increased by 21%, and in dollar terms – by 18%. Despite the record figure in rubles, in the US currency (USD 40.9 bln.), it is far from the record values of 2012: that year, 75 billion dollars were spent on passenger cars.

Obviously, the reason for this is the ruble exchange rate, which has been falling in recent years: the Russian currency has lost half its value over 9 years. In this regard, the capacity of the car market is growing in rubles, which is clearly visible since 2017. In 2020, growth slowed down due to the pandemic, and last year there was a rise in car prices due to a global shortage of semiconductors, which also affected the market capacity.

The domestic Lada brand remains the leader in sales in 2021, whose share in the Russian market is slightly more than 1/5 – 21%, which is 2.1% more than last year. Korean brands Kia (205,801) and Hyundai (167,331) also remain in demand among Russians, which showed growth in 2021 by 2% and 2.5%, respectively. From the list of TOP 10 brands, only three brands fell in sales: Skoda lost 4.4%, Volkswagen - 14% and Nissan – 8.9%. And the greatest growth was demonstrated by the GAZ brand, which produces commercial vehicles – +10.4%.

The rating of the most popular models is also headed by Lada: Lada Granta showed a drop of 11.6% due to a shortage of auto components, thus losing the lead to another model of the brand - Vesta. During the year, 113,698 Vesta and 111,430 Lada Granta cars were sold.

The most popular foreign car was Kia Rio (82,941), despite a decline in sales in the Russian market (by 5.8%). But another model of the Kia K5 brand showed a high sales growth (by 259.6%). More than threefold increase became possible due to the novelty of the model: Kia K5 appeared in the Russian market only in September 2020.

The Russian car market at the beginning of 2022

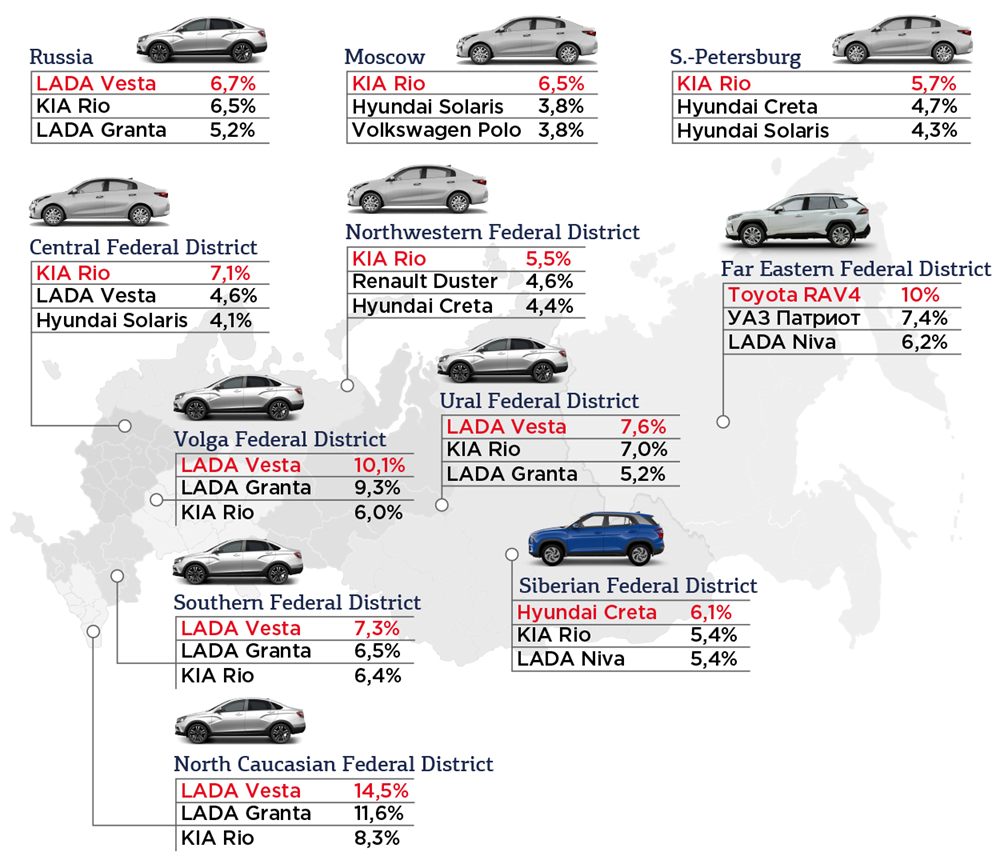

Fig. 14. TOP-3 brands by sales in federal districts, January-February 2022

Source: Autostat

In the first two months of 2022, according to a study by Autostat and data from Electronic Passport, Lada Vesta became the best-selling car in four districts at the same time (Volga, Ural, Southern and North Caucasus), which had the largest sales volumes in 2021. The model occupies the largest market share in the North Caucasus (14.5%).

In the central Federal District Kia Rio, which took 7.1% of the market, moved Lada Vesta to the second place in popularity. Also, the Korean foreign car is leading in the North-Western District (5.5%). The model shows high sales both in Moscow (6.5%) and in St. Petersburg (5.7%). It is worth noting that neither Lada Vesta nor Lada Granta got into the top 3 of these cities.

Also, only in two federal districts, crossovers topped the sales rating: in Siberia this is Hyundai Creta (6.1%), and in the Far East – Toyota RAV4 (10.4%).

The main bestsellers in Russia were four models: LADA Vesta, Kia Rio, Hyundai Creta and Toyota RAV4.

At the beginning of 2022, there was a positive trend in terms of the number of car sales centers.

In January 2022, for the first time in the last 4 years, the number of car dealers in Russia stopped declining. For the first 15 days of January, the growth was 0.3%. At that time there were 3,220 official dealerships in Russia.

If we consider the dynamics of changes in the number of dealerships since 2015, we can see a decrease of 15% (data is compared at the beginning of each year) And every year, except 2015 and 2018, there was a decline. So, from 2019 to 2021, the reduction from year to year became larger: -1.1%, -2.3%, -4.7%, respectively.

The positive dynamics that emerged at the beginning of 2022 can be attributed to the creation of a dealer network of the Chinese brand EXEED in Russia.

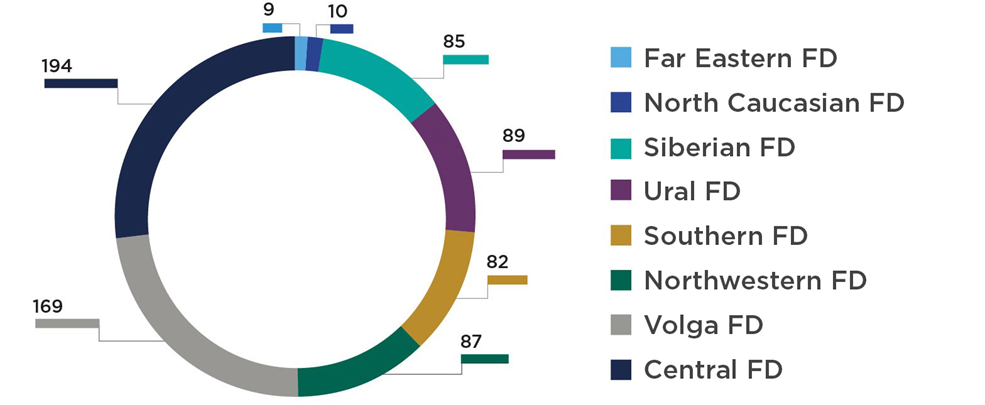

Fig. 16. Presence of Chinese car dealers by Federal Districts in January 2022

The aggravated geopolitical situation may also contribute to an increase in the share of Chinese cars in the Russian market, which has been growing in recent years. Accordingly, the number of dealerships of Chinese brands may increase. Chinese automotive companies can benefit the most from the situation when sanctions are imposed on Russia and, consequently, European, Japanese and American brands are leaving the Russian market. Moreover, according to experts, it is worth waiting not only for an increase in the manufactured cars of brands that are already present in our market, but also for the appearance of new brands.

Prospects of the Russian automotive industry

Despite the fact that Chinese brands will occupy a certain segment of the market, some experts suggest that the Russian car industry and the car market may follow the Iranian path.

Massive sanctions were imposed on Iran in 2012: the volume of the Iranian car market in 2011 (1.59 mln. cars) is comparable to the volume of the Russian market on the eve of sanctions (1.54 mln. in 2021); both states are economically heavily dependent on oil, and both Russia and Iran are striving to create a large-scale own car industry. If Russia does repeat the path of Iran, then next year (2023) it is worth waiting for the market to decrease by about half compared to the indicators of 2021.

Obviously, due to the withdrawal of most foreign brands (primarily Western ones) from the Russian market, sales in March should have fallen. According to Autostat, in March 2022, the Russian car market lost ground by 43% compared to March last year. And according to the AEB, the sale of cars decreased by 63%. The difference of 20% is due to differences in the data that are analyzed: Autostat compares final sales, and AEB - data on the shipment of cars.

Download full version of the research in ppt

You may be interested

Other company news

June 7th, 2023

Recently, the Minister of Agriculture of the Russian Federation Dmitry Patrushev announced the possibility of exporting over 55 million tons of grain in the 2022-2023 agricultural year. Oleg Pakhomov, Head of Management consulting practice DELOVOY PROFIL Group drops more inside info on the storage and logistics perspectives.

August 4th, 2022

Current conditions are pushing the business affected by sanctions to redomiciliation or international restructuration to keep its business contacts, commercial operations, technological collaboration and long-established supply chains.

August 2nd, 2022

An audit has revealed contraventions of labor legislation at several business units. The violations could lead to legal claims from employees and fines from Ministry of Labor up to 196 mln rubles.